The sea can be rough on the surface. At depth, however, its currents are powerful, regular and clearly identified. The same is true when it comes to pre-owned dive replica watches online: from time to time, there may be a real bargain on the crest of a wave, but deep down, the best investments remain the same and are well-known to collectors. Rolex reigns supreme here.

Certified Pre-Owned’ and its related acronym CPO are recent developments, but already cover a great many high quality fake watches that are examined by experts to be authenticated, fully overhauled, documented and assigned a fair value before going on sale. It’s in these realms that WatchBox, Chronext, Watchfinder, Bucherer and other similar platforms operate. They have a twofold aim: providing watch-lovers with timepieces of their choice that they’re unable to find elsewhere; and providing investors with a good investment. Most clients identify with both these aims, seeking to treat themselves to beautiful AAA replica watches whilst also ensuring that it will increase in value. “Generally speaking, good CPO watches are those that also sell well when new”, explains Bucherer.

King Rolex

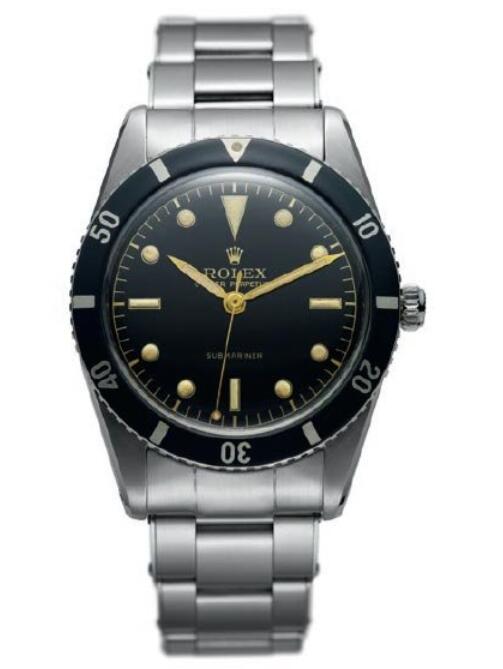

In this game, one brand clearly stands out from all the rest: Rolex, with one model also leading the field: its Submariner. This dive copy watches wholesale ticks all five boxes for the perfect purchase: prestige, history, technical sophistication, aesthetic appearance and rarity. To do well in the Rolex game, you have to know your way around all the types in question, some of which are obscure: a 126610LV is luxury replica Rolex Submariner watches with a green bezel, selling for between $25,000 and $30,000 in 2022 — in theory, it’s available in-store at a retail price of exactly €10,000, but it’s impossible to find. The timepiece isn’t making waves, quietly growing in value by just 10% or so a year, but the experts at WatchBox are categorical: if it were to disappear from the catalogue, the price would increase by 30-40% in the space of just a week.

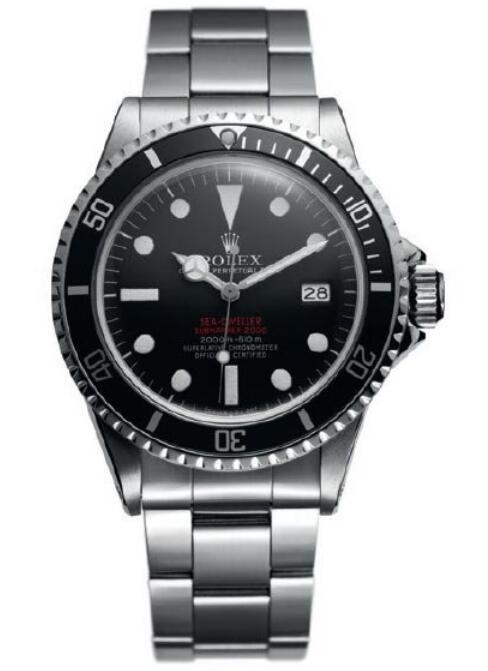

When it comes to vintage perfect fake watches, there are two important references: the 16600 and the 16610. They go for quite similar prices, around $12,000 in 2022 (except for the very special case of the ‘COMEX’ 16610, which commanded between $100,000 and $500,000 in 2022). The first of these is a Sea-Dweller; the second is a Submariner, produced from 1989 to 2010. While they may be quite different models, the two best replica watches are very similar in terms of performance and how they feel on the wrist: they have the same diameter, along with a feel and ethos that binds them together. And while it may be true that calibres take second place to the performance of the case for dive super clone watches paypal, collectors seem to have a particular interest in Calibre 3135, even though its successor, Calibre 3235, is technically superior. The latter’s appeal will doubtless increase, but for the time being, Rolex connoisseurs are as prudent and conservative as ever.

Bucherer notes one other reference that stands out from the crowd — and keeps its head well above water: “Reference 5512 dates back to the mid-1960s. It’s a transitional Submariner, and the first to be labelled a ‘Superlative Chronometer’. It was released at the same time as the 5513 and 1680, but confused the market and ended up not selling well, in particular because it underwent several changes of dial and bezel. The piece is undervalued, and many of them have been destroyed, so it’s one to watch out for.”

Pretenders to the Thorne

Swiss movements Rolex replica watches may reign supreme, but there are a number of contenders for the remaining spots on the CPO podium. The Omega Seamaster and Audemars Piguet Royal Oak Offshore are regularly referred to by CPO specialists as safe bets, although the specific reasons differ: for Omega, it’s all about volume, whereas for Audemars Piguet, value is the key.

To explain: Seamasters have a relatively low value because a whole host of models are still being produced and there are huge numbers of CPO transactions. It’s a standard type of investment, offering few medium-term gains, but easy to buy and resell. The Royal Oak Offshore is quite the opposite: it’s recent (1993), much rarer due to a carefully-managed shortage and a lot bulkier, making it less comfortable to wear. It’s a rare timepiece for experienced collectors: made in small numbers, offering high value and with only a low volume of transactions — but also the promise of a good investment.

Pure Players taking on water

Strangely enough, in a world in which technical prowess is of prime importance, pure players in dive fake watches site such as ZRC, Ralf Tech, Jacques Bianchi, Doxa and even Panerai don’t fare that well. As Watchbox explains: “Panerai’s format rules it out it in the eyes of many, although the early series with Rolex movements hold up well.” And the others? “Doxas, the Omega Ploprof, and even the Rolex Deepsea are difficult to wear”, is Chronext’s assessment.

The Blancpain Fifty Fathoms is a historic piece, but low trading volumes prevent its value from increasing. “It should be remembered that this is one of the first dive 1:1 replica watches to feature complications. It came in for a lot of criticism as a result, but today the practice is widely accepted”, explains Bucherer. This makes it an attractive piece for collectors, but only marginally so for investors. Breitling’s Superocean hasn’t managed to establish itself either: “There are too many of them”, says WatchBox. “It’s a fun watch, made to be worn, rather than an investment.”

CPO values for some brands are however on the rise and should at least be monitored. One such example is Tudor. The brand offers excellent value for money, but its long-term value remains uncertain, as can be seen from the listings for its 1960s/70s watches, which are struggling to widen the gap with current model retail prices. Investing in these top fake watches is a gamble on the future. On the upside, though, this particular bet is open to all takers: for the time being, they remain affordable.